In this article, I will explain how the Electronic Payment Process works, how you can configure it in SAP and what are the different electronic payment file standards used in North America and Europe.

First we will start by explaining what the Electronic Payment Process is about.

Some countries, banks and/or companies would call this Electronic Funds Transfers (EFT), some Electronic Payments, Electronic Payment Orders, Payment Initiation and so on ... But they all refer to the same process.

Now a days, companies instead of issuing a physical check to pay their bills, they have the possibility of issuing Electronic Payments. The process starts when a company executes a payment, with that payment their ERP system (SAP, Oracle, MS Dynamics, Netsuite, etc.) creates a file that contains all the necessary information for the bank to process it and issue a payment to their vendor. The Bank receives this file, reads it and selects all the payments contained inside and sends it to the Clearing / Settlement Entity for its processing. This entity works exactly the same as in the past for check clearing, but process electronic payments instead. Then the payments are sent to the Payee/s bank/s which process them and deposits the funds in the Payee/s / Vendor accounts.

Depending on the country you are in, the country's Banking System will operate differently in terms of Electronic Payment file standards. And even within the same country, banks could be using different standards as well or adapt / tweak them to their own needs. Some could still be using old file format standards or some could have implemented newer and more technological advanced standards already. Requirement need to be analyzed on bank by bank basis.

SAP covers the majority of the main electronic file formats in an standard way. That does not mean they fit 100% as per your bank's requirements. But normally 90% of the standard is covered and you are left with some tweaking to do and be 100% compliant with your bank. The problem is that Banks rarely adhere 100% to the standard and they modify it to suit their own needs. SAP delivers the standard as per the industry.

For example, in the case of SWIFT ISO 20022 standards, SAP is one of the founding members of the board that designed the standards for the industry. So compliance with the standard is guaranteed.

These are some of the most important electronic file standards in different countries / markets:

Each of these standards have their own particularities and minor extra configs that might be needed and could easily be the subject of a Blog posting on its own.

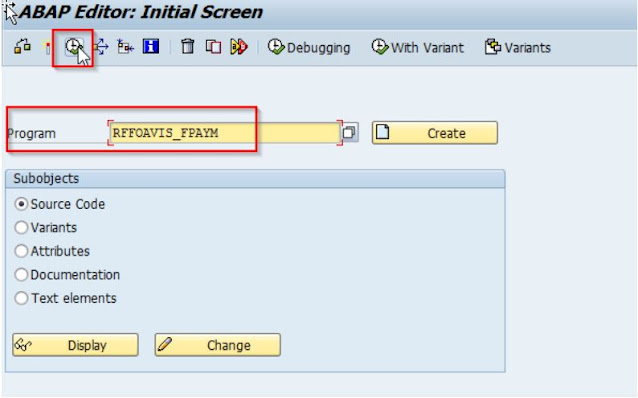

Contrary to what we used to do in the past, you do not need to use the "classic payment medium programs" RFFO* anymore, all of the standards are now present via the PMW. (See my previous Blog posting on the subject for the explanation).After this you will do your config for "Payment methods in Company Code" and "Bank determination". Finally, you have to complete your config in OBPM4 (As described too in the previous posting).

Now depending on your bank's requirements, you might have to do some modifications by using the DMEE or DMEEX, which requires you to have a prior expertise using this tool. In my experience, execpt for ACH in the US, one way or the other I always ended having to do tweakins and adapting it to my bank specific requirements. But always starting from SAP standard delivered formats.

Once the configuration completed you will start your testing. For this purpose you can use Fiori Apps "Manage Automatic Payments" which is the equivalent of F110 and if you need to access and download the created file, you can use "Manage Payment Media" Fiori App that replaced FDTA.

At this point, testing with the bank can start as your main configuration is completed. Testing with the banks is a complex, long and bureaucratic process that by no means you should underestimate how long it will take you. In my experience, this is something that should be started as early as possible in any implementation process.

Some sites for references:

https://en.wikipedia.org/wiki/Single_Euro_Payments_Area

https://www.corporatetobank.com/resources/financial-services-file-formats-and-document-standards/