I decided to publish this Blog post because I could not find anywhere else on the Internet any other post for a scenario like the one that I will describe here.

There are several posts on Activity rate Actual calculation out there, but none of them is using an "Splitting Structure" for multiple activity types withing the same Cost Center. All of them are based on the assumption that 100% of the Cost (rate) of the Activity type covers 100% of the Costs incurred in the Cost Center.

This post is going to describe how you setup an Splitting Structure when the incurred costs of a Cost Center are represented by several Activity Types at the same time.

Ex. If you look at the "T" Account or a Cost Center report for a given Cost Center and you have 30 different Cost Elements (GLs) expenses being posted in that Cost Center.

Normally, you would have 1 Activity Type (& rate) that will represent the entire 30 expense accounts and that will offset 100% of those costs when doing Activity confirmation. That Cost Center will receive credits from it that should offset the entire Cost Center costs.

But ... in certain cases, business do not want to have 1 Activity Type (rate) to offset those 30 different expenses, they want several ones 2, 3, or even more Activity Types within the same Cost Center. In that case, the usage of the Activity rate actual calculation, would require you to setup a "Splitting Structure" to be able to achieve this and have the actual activity rate calculated properly within that Cost Center.

You will start by defining a "Splitting Structure", follow the IMG path above.

First, create "Splitting rules" where in this case we will split based on "Activity quantity".

Then create a "Splitting Structure", Ex. Z1 too.

Note: Part of the descriptions are masked for confidentiality reasons.

Activity Type Setup

Version configuration

Execution

Because of given business reason, we had 1 Cost Center that "concentrated" all the expenses and with allocations from many different Cost Centers we were posting the Debits into this one Concentration Cost Center. All the Activity Types were also assigned to these 1 Cost Center too. Thus, 1:1 relationship that you can easily see here in my Cost Center report. This is only an example, and it is not always that straight. In many cases, you will have 5/6/7 Cost Elements, for a given Activity Type offset.

As per the Cost Center report, you could see that the total expenses posted were $34,273.33 while the Absorption Credits posted by the Activity Types confirmations, where $33,623.33 and were not able to 100% offset the actuals (by $650).

For this, we will calculate Actual Activity rate calculation that will recalculate all the Activity rates to be able to fully offset those actuals and end up with the Debits equal to Credits on the Cost Center report.

1st step before doing the calculation, we need to do a 1 time (per Fiscal Year) setup to assign the previously configured Splitting Structure to my CN599 Cost Center, so the system knows to which Cost Center this Splitting Structure will apply (it can be more than 1 Cost Center too if it applies).

Execute Tcode OKEW and assign it.

If you look at the total results, you will easily recognize those numbers from the previously executed Cost Center report.

Control Cost & Actual Costs columns represent all my Cost Center Debits.

The Actual Cost Balance column, represents the Total Credits done by the activity type postings.

Allocated Actual column, represents the difference that I still need to allocate.

Then within the lines of this report, you will find all the different Activity Types that were posted during the month with their corresponding actual quantities. If your Splitting Structure was properly mounted, your Allocated Costs will properly reflect the right proportional amounts on each line.

Make sure your Structure covers 100% of Cost Elements involved in the Cost Center and 100% of the Activity Types that credited that Cost Center. If for any reason, the structure has a "hole" and does not covers 100% of any of these 2, then your numbers are not going to be properly calculated for all the Activity Types, not just 1. So this is really important.

As a suggestion, in the Splitting Structure when doing the assignment configuration, I strongly recommend you to work with a CE group. This way, you can easily add new CE's in the group without the need of a configuration, transport, testing and the whole bureaucracy of changing configuration on a Production system.

Once this step executed (without test mode), you are ready for the next step which is the Posting.

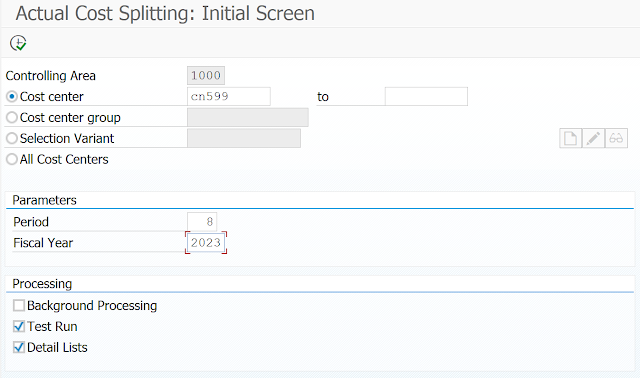

2nd step - Tcode: KSII

Note: If you are using Actual Costing, the allocation cost element from an Assessment like 9042119 needs to be added to the corresponding Cost Components Structure (OKTZ) even if they are not being used for Costing. (This is only applicable in case you are using Actual Cost Component Split, like in my case)

New determined rate for LUNLAB is $ 73,321.74

Total Costs in the Cost Center to offset $ 10,558.33 (show in prior reports)

Total Activity Qty occurred in period 0.144 hr.

10,558.33 / 0.144 = 73,321.74 is (will be) the new rate calculated by the system for LUNLAB

Note: My numbers are really odd because I did not a lot of activity type quantities posted to be able to end up having a rate that would make sense, but you have to follow the math.

Now If I were to remove the "test mode" the system will go back to every single Production Order that had this LUNLAB (and other Activity Types too) and repost everything at the new rate instead of the standard rate that I had from KP06.

To be able to properly determine Actual Activity Type rates, having 7 different Activity Types within the same Cost Center and them being covered by a series of different Cost Elements, is only possible by setting up the Splitting Structure in the way that I described before; otherwise it will not be able to "split" your costs properly among the different activity types.