For those like me that are coming from the old Era of SAP ECC6.0 or before, we used to have 2 different Abap programs that we could run to Switch ON/OFF the Open Item Management flag out of a GL Account Master Data.

Programs

RFSEPA03 Switch OFF Open Item Management

RFSEPA02 Switch ON Open Item Management

This was really helpful because either during Project or Production Support, somehow there was always the need to Flag or Unflag a GL account in terms of "Open Item Management". With the help of those 2 programs, we were able to troubleshoot this requirement.

Now in S/4 HANA those 2 programs are obsolete and cannot be used anymore. They have been replaced by a new program FINS_SWITCH_TO_OPEN_ITEM, it even has its own Tcode too FAGL_ACTIVATE_OP or FINS_ACTIVATE_OIM.

But first to be able to have access and use this program you need to implement an OSS Note that will bring this program into your environment ( 2745769 - FINS_SWITCH_TO_OPEN_ITEM: Activation of Open Item Management ).

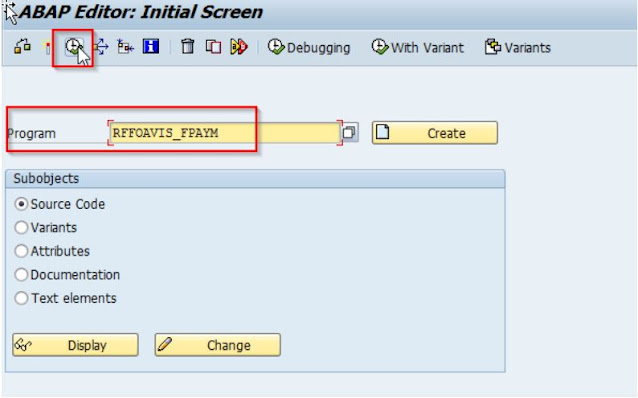

Once the OSS Note is Implemented, you can Execute the program.

- With this program you can either Activate or De-activate the Open Item Management of any GL Account.

- It has to be run Account by Account, you cannot execute multiple GL Accounts at the same time.

- But, you can do it for Multiple Company Codes.

- You can Switch on at a specific Date.

For the "Test run" mode you can do it online, but once you remove the Test run it needs to be executed in the Background and then you will have to review the Execution Log.

Once the program executed, you can verify you GL Account Master Data (FS00) and you will see that the "Open Item Management" flag has been removed or added to the GL record.

If your Company and/or Project needs to implement this, or any of the functionalities described in my Blog, or advise about them, do not hesitate to reach out to me and I will be happy to provide you my services.